LTD Collateral Management System

LCH Ltd’s system for processing and managing margin

The Collateral Management System (CMS) is the heart of LCH's margin processing proposition for our members.

The CMS is an online collateral management application hosted on the LCH Portal which puts you in control, enabling you to prefund margin, recall excess margin and substitute posted collateral, while enhancing transparency on the status of instructions and reducing the risk of errors or omissions.

The CMS enables Clearing Members at LCH Ltd to:

- Instruct movements of securities and cash to/from the clearing house or transfer securities and cash between mnemonics and sub accounts

- Instruct and update triparty collateral transactions

- View online security, cash and triparty balances and headroom as well as online liabilities by account and market and collateral valuations for cash, securities and triparty transactions

- Receive email notifications of instructions and instruction status updates

- Export instruction and balance data to .csv files

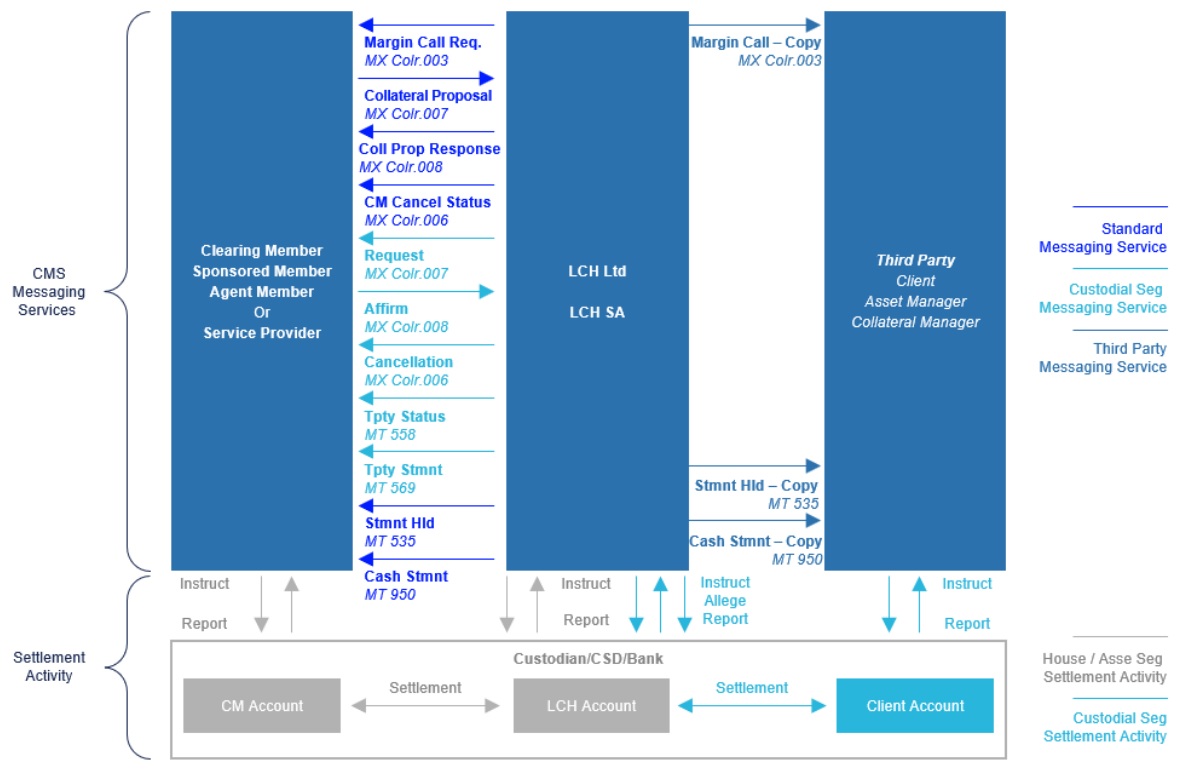

The CMS supports industry standard SWIFT MT (ISO 15022) and MX (ISO 20022) messaging, making managing collateral simpler, more secure and more efficient for our Clearing Members and clients.

CMS Standard Messaging Service

The CMS Standard Messaging Service gives Clearing Members, Agent Members and Service Providers the power to instruct collateral movements with LCH and receive margin call notifications and statement reporting for cash and bilaterally delivered securities. The service is provided in addition to the online CMS User Interface and is available for all account types.

Registration form here.

CMS Custodial Seg Messaging Service

The CMS Custodial Seg Messaging Service provides SwapClear Clearing Members with an interface to affirm or reject triparty transaction adjustments proposed by a client with LCH and receive reporting on the triparty transaction status and underlying security allocations. The service is provided in addition to the online CMS User Interface and is only available for the Custodial Seg account type.

CMS Third Party Messaging Service

The CMS Third Party Messaging Service allows Clearing Members to configure clients, asset managers, collateral managers or other third parties with direct reporting of clearing house margin call notifications and statement reporting for cash and bilaterally delivered securities in respect to individually segregated accounts (ISAs).

Registration form here.

Learn about the CMS Messaging Services and find out how you can improve straight through processing (STP) of collateral

Discover the usage guidelines for all our ISO 20022 and ISO 15022 messages, which are published on SWIFT's MyStandards

LCH Clearing Members and their clients are able to access a repository of proprietary banking reports via the LCH Portal (web or S-FTP). These reports – updated daily – serve as a unique resource only available to LCH customers.

Just log on to the LCH Portal or request a S-FTP connection in order to access exclusive content including reports on:

Banking folder (End of Day reports)

- Overnight Cover Distribution (Report 19)

- Commodity Group Total (Report 20)

- Initial and Variation Margin (Report 21)

- Yesterday’s Cover Account Postings (Report 22)

- Today’s Non-Cover Cash Posting (Report 22a)

- Yesterday’s Posting Total (Report 29)

- Collateral and Exposure Summary (Report 31)

- Member Default Fund (Report 32)

- SOD Non-Cash Collateral Holdings (Report 36a)

- SOD Cash Collateral Holdings (Report 46a)

- Triparty Allocation Summary (Report 50)

Banking folder (Intraday reports)

- PPS Movement Detail (Report 33a)

- PPS Aggregation Detail (Report 33b)

- Non-Cash Collateral Holdings (Report 36)

- Cash Collateral Holdings (Report 46)

Banking folder (Monthly reports)

- Statement of Account (Report 37)

- Monthly Interest (Report 40)

Fees folder (Monthly reports)

- Monthly Collateral Handling Fee (Report 41)

Public/Banking folder (End of Day reports)

- Daily Base Rates (Report 17)

- Daily Exchange Rates (Report 18)

- Daily Exchange Rates All CCY (Report 18a)

- Collateral Prices (Report 34)

- Pay Down Factors (Report 35)

Public/Fees folder (End of Day reports)

- Daily Collateral Fee Report Cash (Report 42_1)

- Daily Collateral Fee Report Non Cash (Report 42_2)

Learn all the fundamentals of collateral reporting.

Discover the text file formats.