What We Clear

ForexClear offers clearing for an ever increasing amount of the OTC FX market

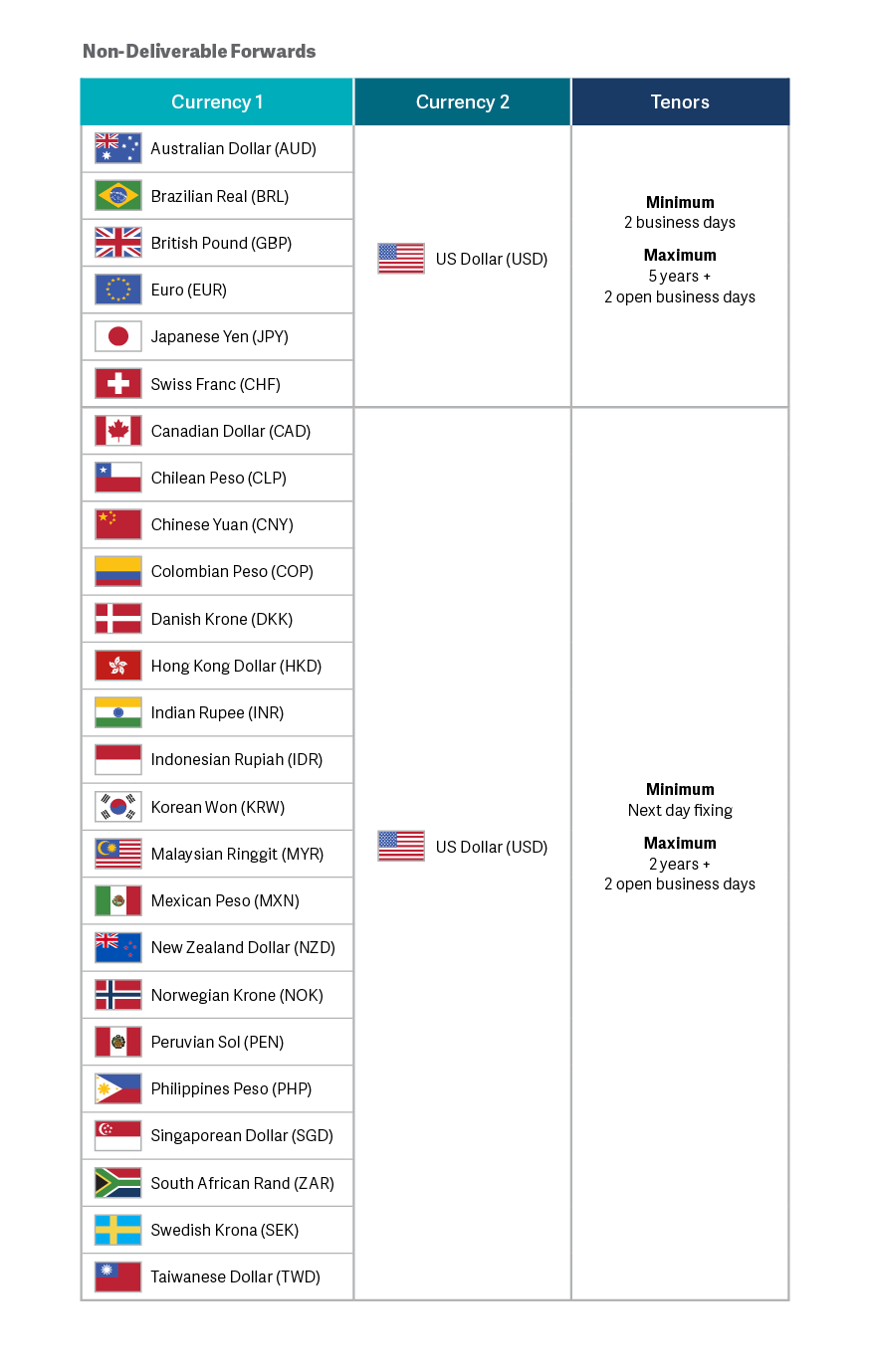

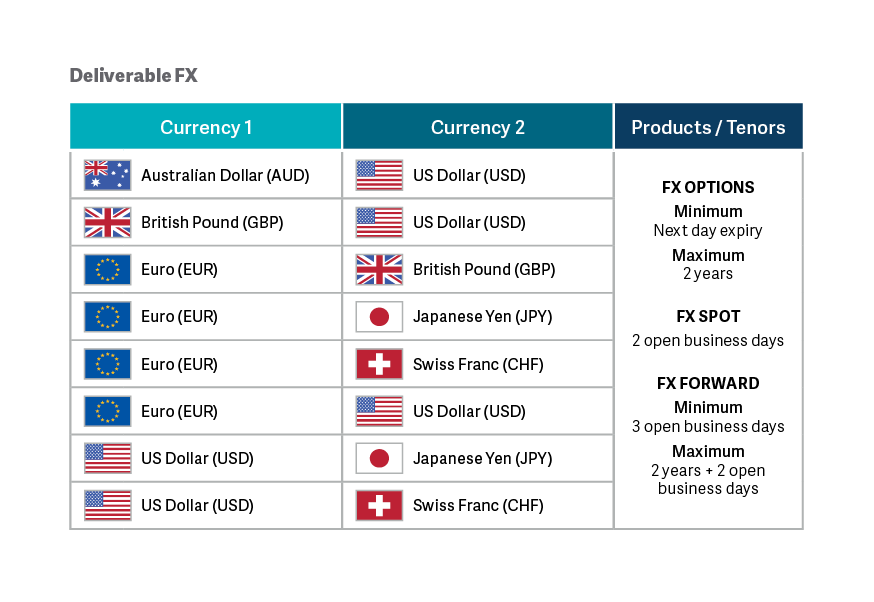

Built in partnership with the FX market, and with the benefit of LCH's extensive experience in rates clearing, ForexClear offers industry leading risk management for 25 non-deliverable forward (NDF) currency pairs, 9 non-deliverable option (NDO) currency pairs, and 8 deliverable (Spot, Forwards and Options) currency pairs.

Trade eligibility

ForexClear subscribes to SwapsMonitor Publications, Inc to determine holidays on the calendars which impact NDF and NDO trade eligibility, and requests its Members to do the same. There are some notable exceptions that Members should be aware of, which are listed below.

- ForexClear does not recognise any Saturday or Sunday as a good day. Any trades received for fixing or settlement on such a day will be rejected.

- The Mumbai holiday calendar, which is used to determine the eligibility of USD/INR NDF trades, is only followed for the current calendar year, until final confirmation is received for the publication of holidays for the following year, which typically occurs in December. Until this time, any holidays outside of the year in question will be disregarded by ForexClear, as these dates are subject to change by the Indian State of Maharashtra.

- ForexClear recognise the 31st December as a valid fixing day for USD/BRL trades unless a New York holiday is announced.

- Due to variations by locality, Islamic holiday ‘Eid al-Fitr’ will remain a good business day for impacted currencies up until the holiday is officially confirmed by respective government sources. Any cleared trades impacted by the official holiday announcement will be subject to adjustment in accordance with the relevant business day convention as per the EMTA template.

Unsure about how an OTC FX instrument can be converted into a cleared position? The process begins in exactly the same way you would execute a bilateral FX trade today.

Trades are negotiated and traded bilaterally between parties. Counterparties can then independently submit their trade side to be matched at a middleware provider or, if executed on a trading venue which is directly connected to LCH, the venue will match and submit the trade directly to LCH on your behalf.

Once received and novated, notification of trade status updates are relayed from ForexClear to members via the middleware provider or venue. Counterparties can also be sent direct notification of clearing acceptance via the ForexClear API.

Once both legs of the trade are facing LCH, we calculate margin requirements for counterparties on an intraday basis and we undertake the fixing and settlement of trades on maturity.

The trade-related flows (e.g. principal settlement, variation margin relating to settlement of trades) associated with the clearing of Deliverable FX cleared via the ForexClear service are settled daily in conjunction with CLS (CLS Bank International). LCH Limited has a dedicated payment window at CLS to process these payments. Each day ForexClear issues a Pay-In Pay-Out (PIPO) schedule to ForexClear Clearing Members and CLS. The schedule shows the amounts expected to be paid/received by each Clearing Member into the CLSClearedFX Settlement Session, which will close once all obligations have settled.

Our members and clients can register trades 24 hours a day, 5.5 days a week.

The transfer of cash collateral, trade settlement and any other cash transactions associated with ForexClear are facilitated by LCH’s PPS, a direct debit arrangement under which participating banks commit to meet cash calls following instructions from LCH.