LCH RepoClear SA

LCH’s France-registered cash bond, repo and €GCPlus triparty basket repo clearing service

RepoClear SA is LCH’s market-leading government bond cash, repo trade and €GCPlus triparty basket repo clearing service. Established in 1999 as a clearing service for French government securities and repo trades, the service has since added the Italian, Spanish, German and Belgian markets (2017). In January 2019, RepoClear SA extended its clearing services to eight additional Euro markets, namely: Austrian, Dutch, Finnish, Irish, Portuguese, Slovakian, Slovenian debts and Supranationals.

We remain committed to building out our product suite with our market partners, ensuring that RepoClear SA continues to occupy its important role in European clearing.

€GCPlus triparty basket repo market enables members to pool general collateral trades of highly rated sovereign debt and agency issuers, as well as other investment-grade bonds that meet eligibility criteria from two baskets of debt. It also enables members to increase their capital and operational efficiencies and better manage their euro cash liquidity – which is especially important given the ongoing impact of regulatory capital requirements.

Market participants can choose from the following membership options at RepoClear SA:

Individual Clearing Member (ICM) – A member authorized to clear their own business

General Clearing Member (GCM) – A member authorized to clear their own business and/or that of Associated Trading Members

Associated Trading Member (ATM) – A firm that trades on trading and matching platforms and has entered into a clearing agreement with a member

Special Clearing Member (SCM) – A member authorized to clear their own business under special conditions

Sponsored Clearing Member – A member currently not able to have direct access but can via the sponsorship of their Agent Member

Agent Member – Acting on behalf of the sponsored member to assist in meeting contractual and operational obligations of the clearing membership

RepoClear SA provides clearing services for cash bonds, repos and €GCPlus triparty basket repo transactions traded bilaterally among financial institutions and executed on the following trading venues:

- Trading Platforms: Euro-MTS, MTS-France, MTS Italy, MTS Associated Markets, CME (BrokerTec), TP Repo (TP ICAP), Tradeweb and GLMX

- Trade Matching: ETCMS – Euroclear Trade Capture and Matching System (Euroclear’s matching system)

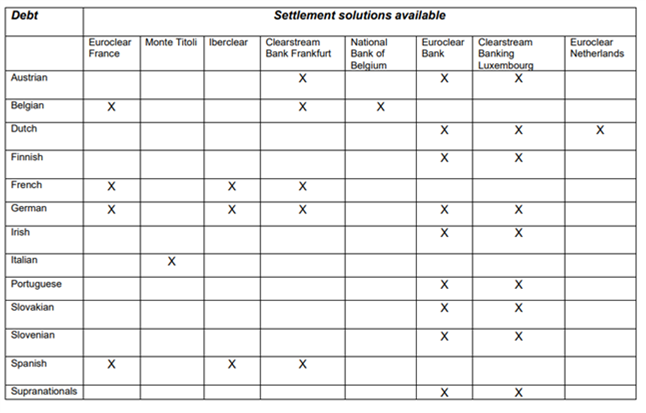

These transactions are processed by RepoClear SA and are settled by:

- National Bank of Belgium (NBB) for the Belgian debt

- Clearstream Banking (Frankfurt) for French, Belgian, Austrian, Spanish and German debts

- Clearstream Banking Luxembourg for German, Austrian, Dutch, Finnish, Irish, Portuguese, Slovakian, Slovenian debts and Supranationals

- Euroclear France for French, Belgian, German and Spanish debts – and triparty basket repo

- Euroclear Netherlands for Dutch debt

- Euroclear Bank for German, Austrian, Dutch, Finnish, Irish, Portuguese, Slovakian, Slovenian debts and Supranationals – and triparty basket repo

- Iberclear for French, German and Spanish debts

- Euronext Securities Milan for Italian debt

LCH SA and Euronext Clearing have an agreement under which LCH SA and Euronext Clearing provide clearing services for Italian government bond transactions executed on the MTS S.p.A. and BrokerTec platforms. These trades are settled by Euronext Securities Milan.

Cash bonds and repo products eligible for clearing at RepoClear

RepoClear has a robust and proven risk and default management framework

Prices to clear your trades with RepoClear

Total Yearly Nominal in €bn

Everything you need to know about clearing at RepoClear

Latest RepoClear enhancements

Questions about RepoClear? Don’t hesitate to get in touch

A repository of the latest thinking and useful links from the RepoClear team