What We Clear

Cash bonds, repos and triparty basket repo products eligible for clearing at RepoClear

Repo Trades

We clear repo trades on all markets listed below:

|

French debt |

Including quasi-government CADES |

|

|

Italian debt |

|

|

|

Spanish debt |

|

|

|

German debt |

Including pfandbriefe, regional government bonds and agency |

|

|

Belgian debt |

|

|

|

Austrian debt |

|

|

|

Finnish debt |

|

|

|

Irish debt |

|

|

|

Netherlands debt |

|

|

|

Portuguese debt |

|

|

|

Slovakian debt |

|

|

|

Slovenian debt |

|

|

|

Supranational debt |

Including EIB and European Union bonds |

|

| Basket 1 (LCR equivalent) | ||

| Basket 2 (ECB restricted) | ||

| GovSSA basket | ||

| Green basket | ||

| Italian basket | ||

| Spanish basket | ||

| French basket | ||

| German basket |

Repo trades have the following characteristics:

Type: classic repo for all debts. Buy and Sell back only for the Spanish debt and with a maturity date before 30-April-2025

Repo rate: fixed or variable for all markets, except Italy, and triparty basket repos where only a fixed rate is accepted

Initial Settlement: start date of the repo, which can be trade date (same-day repo) or any future date (forward start repo)

Return Settlement: end date of the Repo, which can be trade date +1 or any future settlement date

RepoClear SA clears cash bond trades of bonds issued by any of the above governments.

Initial Settlement: from trade date +1 to any future settlement date.

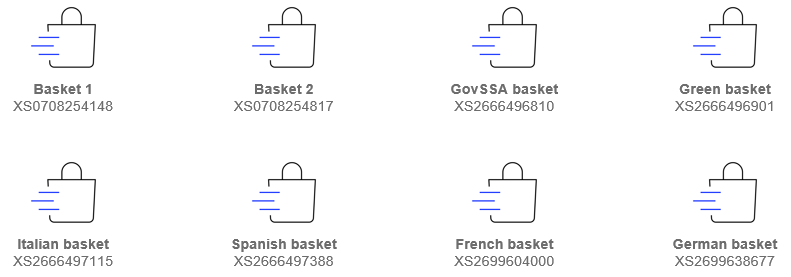

€GCPlus Triparty Basket Repo

€GCPlus triparty basket repo market enables our Clearing Members to access and clear secured Euro cash funding through standardised baskets of ECB eligible collateral debt securities.

When clearing €GCPlus triparty basket repos, members can pool collateral of specific criteria into the following baskets:

- Basket 1: based on European Central Bank (ECB) High-Quality Liquid Assets which support Liquidity Coverage Ratio (LCR) principles

- Basket 2: covers an extended spectrum of ECB eligible securities

- GovSSA basket: covers some Governments, Subnationals, Supranationals and Agencies bonds

- Green basket: our very first green offering delivered in partnership with Euroclear to support our members navigate through industry developments

- Italian basket: includes Italian government bonds acceptable for bilateral RepoClear trades now offered under triparty

- Spanish basket: same scope of Spanish government bonds acceptable for bilateral RepoClear trades now offered under triparty

- French basket: same scope of French government bonds acceptable for bilateral RepoClear trades now offered under triparty

- German basket: same scope of German government bonds acceptable for bilateral RepoClear trades now offered under triparty

Once the trade basket is settled at Euroclear, Clearing members enjoy automated collateral management (provided by Euroclear) by having complete control over collateral reuse within Autoselect.

For further information on €GCPlus baskets, please send your request to repocleargroupsales@lch.com

Looking for information on whether a given debt security is eligible for inclusion in one of the €GCPlus triparty baskets and is acceptable for clearing? View €GCPlus list of eligible securities