SA Acceptable Securities

At LCH SA, Clearing Members and their clients are able to post debt securities issued by high quality sovereign government issuers and certain government agencies to meet initial margin obligations.

LCH SA accepts three forms of non-cash margin:

-

Securities collateral: deposited via Full Title Transfer Accounts opened by LCH in various Central Securities Depositories (CSDs)

-

Central Bank Guarantee offers provided by the National Belgium Bank (NBB) or Dutch National Bank (DNB)

- Pledge Solution: enables CDSClear and RepoClear members to enter into a collateral arrangement whereby it deposits eligible collateral via a Single Pledgor Pledged Account (SPPA) opened by LCH SA in Euroclear Bank

Securities Collateral Haircuts

All securities posted as collateral are subject to “haircuts”. The size of the haircut is influenced by the tenor of the bond pledged. Haircuts are typically smaller for bonds with shorter maturities and higher for securities with longer tenors.

For the most up-to-date information on RepoClear, Cash Equities, Listed Derivatives & CDSClear haircuts, please log into the CaLRM secure area.

Looking for more detailed information on the regulations regarding posting collateral at LCH SA? The links below provide a deeper dive on all matters concerning pledging margin on our clearing services.

Unsure whether a security is eligible as initial margin collateral at LCH SA?

Securities are transferred to LCH SA, these securities are held by LCH SA under te terms of a deed of charge between LCH SA and the respective Clearing Member or Client.

To facilitate margin delivery, Clearing Members may lodge securities either directly with LCH or using a tri-party arrangement. All Clearing Member proposals for the lodgement, release or substitution of securities must be submitted through the Collateral Management System (CMS)

The following concentration limits apply to each Clearing Member, in respect of its securities collateral*:

Italian, Spanish and Portuguese Securities

For Italian, Spanish, and Portuguese members:

- Cannot deposit Portuguese securities

- Can deposit Spanish and Italian securities in a cumulative limit of the lowest between (i) 50% of the value of the margin requirement (EUR equivalent) and (ii) EUR 250 million

For other members:

- Can deposit Spanish, Italian, and Portuguese securities in a cumulative limit of the lowest between (i) 50% of the value of the margin requirement (EUR equivalent) and (ii) EUR 500 million of which EUR 100 million of Portuguese Securities

Supranational and European Agency Securities

- The lower of (i) 50% of the value of the margin requirement (EUR equivalent) and (ii) EUR 500 million

Non-Euro Non-Cash and Pledge

- Below or equal to 15% of the margin requirement (EUR equivalent)

- For CDSClear, “Non-Euro Non-Cash” up to 15% of margin requirement (pledge excluded)

*The following additional concentration limits apply at a group level across all Clearing Members within the same group:

Italian, Spanish and Portuguese Securities

- For Italian, Spanish, and Portuguese members (no Portuguese securities allowed): EUR 250 million

- For other members: EUR 500 million

Supranational and European Agency Securities

- For all members: EUR 500 million

For additional information about posting non-cash collateral at LCH SA please see Instruction IV-4.1 and Section 3 of the Procedures. Note that other concentration limits may be applied (OA concentration limit, …)

For further information, please contact collateral.ops.fr@lch.com.

Collateral Operating Procedure

Equities, Listed Derivatives & Fixed Income

For non-cash collateral:

1 – Lodge of securities:

11- On D-1, CMS Instruction is sent at 16:00 CET to LCH SA;

12- On D, the member instructs (Franco or Sell Free of payment) in the relating CSD for matching against LCH SA instruction;

13– On D, if settlement occurs before 12:00 PM CET and if cash return requested in CMS instruction by the member, the excess cash balance, available after the reception of the new non-cash collateral, is paid back to the member between 12:00 and 13:00 PM CET.

14– For all settlements occurring after 12:00 PM CET, the cash restitution is done on D+1 only, through the initial margin call (8:30-9:00 AM CET).

2 – Release of securities:

21– On D-1, CMS Instruction is sent at 16:00 CET to LCH SA;

22– On D, the Initial margin call calculation run excluding the requested collateral and the member is called for the relating amount in euro cash in TARGET2 system (8:30-9:00 AM CET);

23 – On D, after confirmation of member’s margin call payment (9:00 AM CET), LCH SA releases its instruction (Sell free of payment) for matching in the relating CSD.

3 – Linked trades (same day deposit and release):

31– Member links its release (in the CMS instruction) to the settlement of a new lodge; the release is only taken into account by LCH SA after the confirmation of the settlement of the linked lodge and without any additional cash to call.

32 – When the linked lodge is not executed before 12:00 PM CET, both instructions (lodge and release) are systematically rejected in CMS by LCH SA.

For further information, please contact collateral.ops.fr@lch.com.

CDSClear

Deposit & withdrawals notifications have to be done via the Collateral Management System (CMS) made available on the LCH group web Portal. To request an access to CMS, please reach out to the Business Development & Relationship Management Team (cdsclearbusinessdevrm@lch.com).

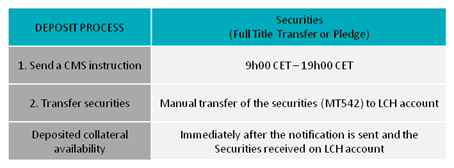

Securities Deposit

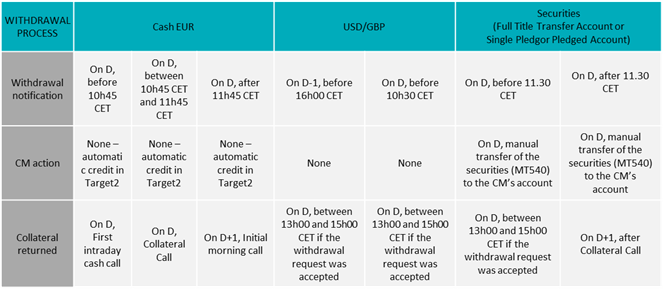

Securities Withdrawal

More technical information on the holding and processing of collateral under the various segregated account structures available to LCH SA Clearing Members and their clients can be found in this helpful document.