Essentials

Learn about some of the fundamentals of clearing, how OTC trades reach SwapClear from the venues where they are executed and information around settlement pricing and other infrastructure.

Typically, the SwapClear Service will be open every day, except weekends, Christmas Day, New Year's Day and Good Friday, with trade registration available from 09:00 Sydney time on Monday to 19:00 New York time on Friday. For full details of SwapClear opening hours, please refer to section 1.2 here and section 2.1.2 here.

The first step toward clearing an interest rate swap at SwapClear, is to execute a rates trade in the marketplace with another counterparty.

In the US, the Dodd-Frank Act mandates that certain interest rate swaps be traded on a trading venue registered as a Swap Execution Facility (SEF) or a Designated Contract Market (DCM).

However, not all rates products that we clear are required to be traded on a SEF or DCM. Some clearable instruments can be traded bilateral directly with another counterparty, such as a swap dealer.

Comparable rules were implemented in the EU on January 2018. Under MiFID II and MiFIR directive, certain interest rate swaps are obliged to be traded on trading venues which are Regulated Markets, Multilateral Trading Facilities (MTF) or Organised Trading Facilities (OTFs).

To date, SwapClear has established connectivity with 40 execution venues.

Trading venues can connect to SwapClear via a middleware provider, such as MarkitWire and Traiana, or through our proprietary direct connectivity platform, ClearLink. Venues may opt to connect through multiple connections via ClearLink.

Trading venues are required to complete an extensive onboarding process whether connecting directly or indirectly to the clearing house. A summary of the process and onboarding requirements can be found here :

SwapClear Trading Venue Quick Start

SwapClear Trading Venue Joint Operating Procedures

SwapClear ClearLink Information

See below for list of the venues currently onboarded to SwapClear and their connectivity methods:

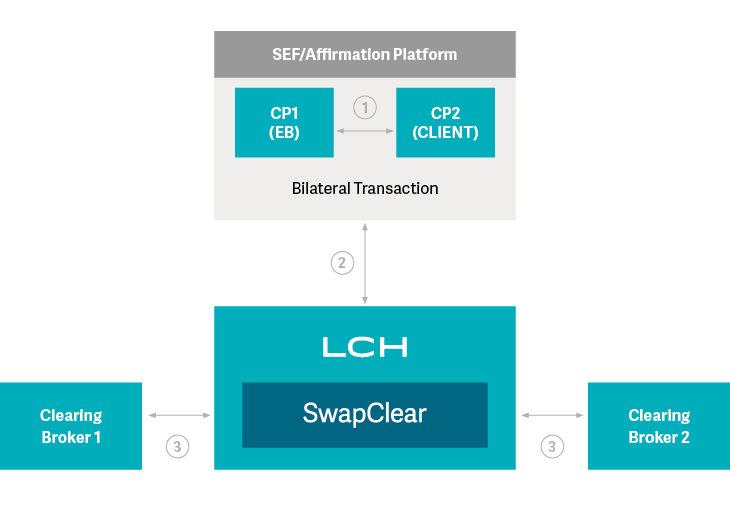

The process of how a client trade is submitted and registered at LCH is straightforward.

The workflow below illustrates the trade registration process for a trade executed between a Client and an Executing Broker (EB).

- The Client and EB agree a trade that is affirmed either through a middleware or a trading venue.

- The fully matched trade is submitted to clearing. A trade validation check is carried out.

- If the trade is deemed as valid, the Clearing Broker will receive a message and either accept or reject the trade. If accepted and there is sufficient collateral available to cover the incremental margin requirement the trade will then be novated to the Clearing House.

Note:

If the trade was originally executed “ON-Venue” on a SEF, DCM, MTF, OTF, QMTF or RM and passes the eligibility checks, SwapClear will process the trade in a Straight Through Process (STP) fashion in accordance with the Clearing Broker Election. Acceptance messages will be issued to the trading venue. Clearing Brokers are required to notify LCH of the trading venues it has onboarded. This information will be stored within LCH and utilised during the trade registration process (see grid below).

If the trade was executed OFF-Venue, submitted for clearing by a middleware provider and passes the eligibility checks, SwapClear issues a request acceptance message to the FCM or SCM, which then has the opportunity to accept the trade for clearing. Once the FCM or SCM accepts the trade, SwapClear sends an acceptance message back to the middleware.

After FCM or SCM issues acceptance, the trades are registered in SwapClear as long as sufficient collateral has been posted. If the trade fails, SwapClear issues a rejection message with the reason for rejection

| Execution Type | Venue | Election | Resulting Trade Workflow |

| Trade executed on a SEF , DCM, MTF, OTF or RM | A | Approve | Auto Process |

| Trade executed on a SEF , DCM, MTF, OTF or RM | B | Approve | Auto Process |

| Trade executed on a SEF , DCM, MTF, OTF or RM | C | No | Rejection |

Final settlement prices are published daily for swaps in all 18 currencies currently eligible for registration at LCH at 09:00 EST/14:00 London.