Essentials

Everything you need to know about clearing at CDSClear

Submitting your index or single name CDS trade for clearing could not be simpler at CDSClear.

The opening hours of the CDSClear service follow the TARGET2 business calendar. The CDSClear service is open and available to receive trades for real-time registration when the margin call process is complete. It starts at 8:30am CET and in any case no later than 9:05 am CET to 7:30 pm CET when TARGET2 is open.

Whether you’re clearing a newly executed transaction or entering an existing trade into clearing through backloading, CDSClear makes managing your cleared portfolio easy.

- New trades: CDSClear sources new trades from major interdealer brokers, MTF/OTF platforms and off-SEF execution platforms.

- Backloaded trades: Bilateral trades reported at DTCC can be backloaded through a weekly process (interdealer trades only) or a daily process.

- Effective reporting and monitoring: trade statuses are fed back in real-time to Clearing Members through the LCH Clearlink API which offers real-time messaging and reports.

- Reporting cleared trades with trade repositories: Cleared trades are registered in DTCC’s Trade Information Warehouse and reported to the CFTC via DTCC’s Global Trade Repository in the US. CDSClear reports its trade legs to the European regulators via UnaVista in Europe.

Trade Submission

|

Approved Trade Source Systems |

Platform |

||

|

MarkitServ Ltd* (MarkitWire middleware) |

MarkitWire and NCM |

||

|

MarkitServ LLC |

DTCC (weekly backloading) |

||

|

Bloomberg Tradebook Singapore Pte LTD |

Bloomberg off-MTF |

||

|

Bloomberg Trade Facility LTD |

Bloomberg MTF |

||

|

Bloomberg Trading Facility BV |

Bloomberg MTF |

||

|

Bloomberg SEF LLCH |

Bloomberg SEF |

||

|

TradeWeb Europe LTD |

Tradeweb MTF |

||

|

TradeWeb EU BV |

Tradeweb MTF |

||

|

TW SEF LLC |

Tradeweb SEF |

||

|

BGC Derivatives Market L.P. |

BGC SEF |

||

|

GFI Swaps Exchange LLC |

GFI SEF |

||

CDSClear Compression Offerings

CDSClear provides two different options for Clearing Members to compress (net) their trades in order to reduce the cleared gross notional managed by CDSClear:

- Automatic Compression

- Ad hoc Compression

Trade compression is optional and has no impact on the risk calculation, since the net position on an instrument remains identical prior and after compression. Clearing Members may decide unilaterally to compress their trades.

Prerequisites

- Fungible trades - Clearing Members must have a set of cleared trades that can be compressed together according to the fungibility rules defined below.

- Upfront settled - Only trades for which the upfront has already been settled (either bilaterally or through CDSClear) can be compressed together.

- Access to the Compression Application of the Web Portal - Clearing Members must have an access to the Web Portal in order to configure the automatic compression settings and enable it to upload the ad hoc compression file.

Fungibility

Trades can be compressed together only when they are fungible, belong to the same trade account and when the upfront has been settled.

Compression is based on the criteria below.

|

Compression Fungibility Criteria |

Index |

Single Names |

Options |

|

Trade Account |

Yes |

Yes |

Yes |

|

Index / Reference Entity |

Yes (RED9) |

Yes (RED6) |

Yes (RED9) |

|

List of fungible Reference Obligations (Ref Ob ISINs) |

N/A |

Yes |

N/A |

|

Maturity Date |

Yes |

Yes |

N/A |

|

Fixed Rate |

Yes |

Yes |

Yes |

|

Currency |

Yes |

Yes |

Yes |

| Contractual Definitions |

Yes |

Yes |

Yes |

|

Transaction Type |

Yes |

Yes |

N/A |

| Option Maturity Date | N/A | N/A | Yes |

Automatic compression

The automatic compression can be enabled and configured on the LCH Group Portal by selecting the Compression Application.

The automatic compression can be enabled and configured with different settings

Frequency

- Daily - Monday to Friday.

- Weekly - Thursday. Thursday is the standard day for weekly compression as it will also include the trades resulting from the weekly backloading cycle.

- By default, compression is disabled and set to “Never”. Once compression is enabled by the Clearing Member, whether it is set to Weekly or Daily and whenever a trade is cleared through backloading, compression will occur.

- If clearing does not occur on a Thursday for the weekly cycle for any exceptional reason, weekly compression will still run on that given Thursday. In this case, it is suggested that Clearing Members change their compression settings the day prior to the clearing day to have simultaneous weekly cycle trade clearing and weekly compression.

Trade account (firm level)

-

Clearing Members that have several trade accounts either for their own activity or for their client activity, can decide that compression should be enabled only for a given set of trade accounts. Trades that are registered in different trade accounts cannot be compressed together.

-

A Clearing Member willing to apply compression for a given trade account will be able to select its client and select “Firm level”.

Desk-ID level

-

Trade segregation within a trade account - Clearing Members or their clients may be using desk-ID’s to manage their trades. Compression can run at desk-ID level, allowing trades with a given desk-ID to be compressed together. Desk ID becomes a fungibility criteria. Trades with no desk-ID will not be compressed together i.e. blank/empty field is not considered a single desk-ID

-

Setting exclusion rules - The configuration at desk-ID level works with the definition of exclusion rules. Clearing Members actually define the list of desk-IDs that will not be taken into account for compression. The other desks will be selected for compression. Finally, exclusion rules can be defined with a start and end date.

-

Case sensitivity - The case the desk-ID is expressed in is taken into account. Trades with differing desk-IDs (due to the case) will not be compressed together as they will be considered as belonging to two separate desk-IDs.When enabled, automatic compression runs immediately after the morning margin call at 8.55am CET.

In the event where an intraday trade has been cleared on D, the upfront is settled on D+1 at the morning margin call. If automatic compression is enabled, the trades will be compressed immediately after the morning margin call on D+1.

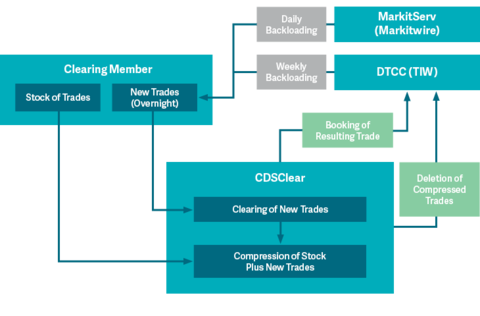

When automatic compression runs, the following sequence of events occurs:

- CDSClear takes into account the current stock of cleared trades and the potential new trades that have recently been cleared following the margin call through daily or weekly backloading

- CDSClear compresses the trades based on the settings defined above

- This will result in CDSClear deleting all trades involved in the compression and creating one resulting trade per contract. In case of flat compression, no resulting trade is created and only deleted trades will be visible from a reporting perspective

- CDSClear sends messages to the TIW to delete all trades impacted by the compression

- CDSClear sends messages to the TIW to create the resulting trade. In case of compression following daily or weekly backloading, trades are cleared one by one, then they are compressed; but only the resulting trade will be registered in the TIW.

Ad hoc Compression

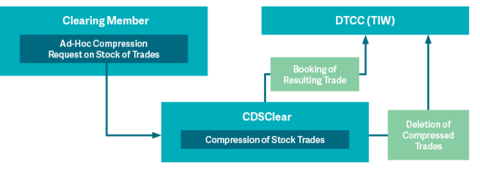

With ad hoc compression, Clearing Members can decide which trades should be compressed together and when. This option offers more flexibility for trade compression.

Ad hoc compression can be performed anytime during the CDSClear business clearing hours which is from 9.05am CET to 7.30pm CET.

When an ad hoc compression file is sent to CDSClear by a Clearing Member, the following sequence of events occurs:

- CDSClear takes into account the trades listed within the ad hoc compression file, provided by the Clearing Member

- This will result in CDSClear deleting all trades involved in the compression and creating one resulting trade per contract). In case of flat compression, no resulting trade is created and only deleted trades will be visible from a reporting perspective

- CDSClear sends a message to the TIW to delete all trades impacted by the compression

CDSClear sends messages to the TIW to create the resulting trade.

Margins are called on all TARGET2 business days. TARGET2, London and US, Sydney, Singapore, Auckland, Tokyo business calendars are used for product related calculations. This applies to upfront payment dates and quarterly coupon payment dates

The CDSClear calendar is available on the LCH's Knowledge Centre.