LTD Acceptable Cash

Initial Margin:

LCH Ltd accepts the following currencies as cover for initial margin intraday and end of day:

Non-FCMs*

- USD

- EUR

- GBP

FCMs

- USD

- EUR**

- GBP**

In addition, LCH accepts Singapore Dollars subject to a maximum of 500mn at Clearing Member Group Level and Entity Level.

* By prior agreement with the Collateral and Liquidity Management – Front Office team contacts here, Clearing Members may also deposit:

- Swiss Francs, subject to a maximum of CHF 300mn per Clearing Member

- Small amounts of the following currencies

- Australian Dollars (subject to the Clearing Member being a participant in the Australian PPS);

- Canadian Dollars;

- Japanese Yen;

- Swedish Krona;

- Danish Krone; and

- Norwegian Kroner.

** For FCM purposes, cash collateral can only be accepted in USD unless margin is being paid on a USD currency holiday.

Variation Margin: All calls for variation margin must be met in cash and in the currency of the underlying exposure.

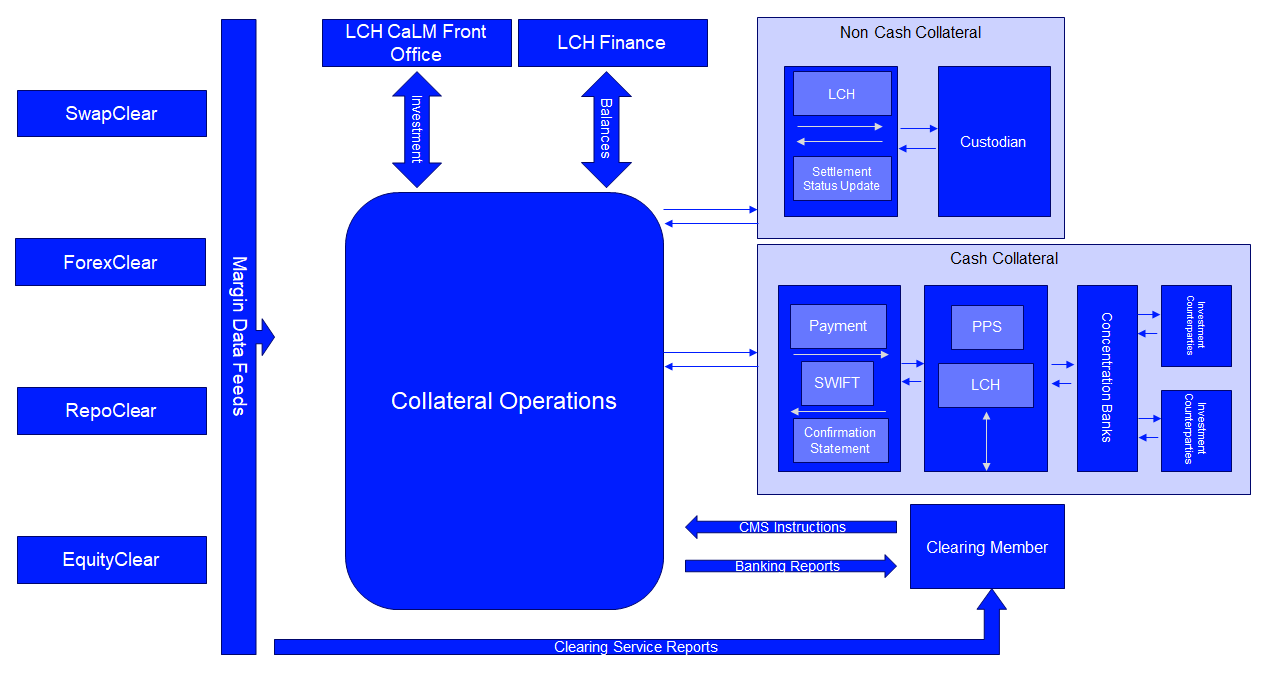

Cash collateral is transferred to and from LCH Ltd on a title-transfer basis using the Protected Payments System (PPS) which grants the clearing house direct debit authority over Clearing Member cash accounts at a commercial bank.

Cash Collateral denominated in SGD may also be deposited directly into LCH’s MEPS+ RTGS account with the Monetary Authority of Singapore.

LCH automatically transfers cash to meet a Clearing Member’s margin calls or upon instruction from the Clearing Member via LCH’s Collateral Management System (CMS).

CMS gives Clearing Member’s complete autonomy in managing margin enabling you to pre-fund, recall excess and substitute collateral as required.

For additional information about posting cash margin at LCH Ltd please see Section 3 of LCH Ltd’s Procedures .

LCH Ltd operates a direct debit system, known as the Protected Payments System (PPS), for the transfer of funds to and from Clearing Members. A Clearing Member is required to maintain PPS bank accounts in London in GBP, EUR and USD and for each currency in which it incurs settlements at one of the participating PPS banks. Different banks can be used for different currencies.

Clearing Members are also required to maintain a USD account at one of the specified banks for PPS in the US. Any bank charges arising from the operation of a PPS account are for the account of the Clearing Member. A PPS mandate must be completed, the original of which is held at the PPS bank and a copy lodged with LCH Ltd.

Participating PPS banks are as follows:

UK PPS Providers for LCH Ltd:

- Bank of America

- Barclays Bank Plc

- JP Morgan Chase Bank

- Citibank NA

- Deutsche Bank AG

- Lloyds Bank Plc

- HSBC Bank Plc

- Natwest Bank Plc

- The Bank of New York Mellon

- Bank of China Limited, London Branch

You can access a copy of the relevant UK PPS Mandate below:

- SwapClear UK PPS Mandate

- EquityClear UK PPS Mandate

- RepoClear UK PPS Mandate

- ForexClear UK PPS Mandate

US PPS Providers for LCH Ltd:

- Bank of America NA (New York)

- The Bank of New York Mellon (New York)

- Citibank NA (New York)

- JP Morgan Chase Bank (New York)

- BMO Harris Bank NA (Chicago)

- HSBC Bank USA (New York)

- Bank of China Limited, London Branch

- Barclays Bank PLC (New York)

You can access a copy of the US PPS Mandate here.

Please review our Mandate Guide for assistance with completing the PPS Mandates

Key points for banks operating or applying to operate the PPS:

- LCH has two PPS infrastructures:

- UK PPS which operates up to 15:59 London time

- US PPS which operates from 11:00 – 17:00 EST

- The PPS infrastructure interfaces with SWIFT to send and receive instructions.

- UK PPS banks must operate on all days which LCH is open, including UK and international currency holidays.

- US PPS banks must operate on all days which LCH is open with the exception of USD holidays whereupon US PPS is closed.

- PPS banks must have agreed contingency processes to guarantee the generation and receipt of instructions.

- PPS banks are required to participate in due diligence reviews on an annual basis

A PPS Onboarding Guide can be found here.

Protected Payment System and Concentration Process - Risks

|

Activity |

Timing (UK time) |

Risk |

|

Overnight PPS calls sent |

By 08:00 |

Clearing Member is liable for fulfilment of its obligation. |

|

Overnight PPS calls confirmed by PPS banks |

09:00 |

Overnight PPS calls must be confirmed by 09:00 by PPS banks. Until the PPS bank has transferred funds to the concentration bank, the Clearing Member remains liable to fulfil its obligation if the PPS Bank defaults. |

|

Auto-repay payment instructions released |

09:15 |

Members that have requested auto-repay (where available) are automatically repaid any excess cash balances that remain on their account(s), repayments (PPS pays) [OT1] may be funded partially or wholly by Margin Calls (PPS calls) made against other Members utilising the same PPS Bank and/or concentration of funds. [OT2] Where PPS pays are funded by the concentration of funds, LCH's obligation to pay the transfer amount is extinguished once its concentration account is debited. |

|

Clearing Member requests for withdrawal of funds |

09:30 |

Cut-off for requesting return of excess cash balances for Clearing Members not on auto-repay. |

|

Concentration process |

09:30 |

Funds are transferred to/from the PPS banks. PPS banks must transfer funds from LCH's account to the concentration bank within two hours following receipt of instruction. |

|

Intra-day calls and Clearing Member pre-funding requests (UK PPS) |

09:00 - 16:00 |

Intra-day calls must be confirmed within one hour following receipt of instruction by the PPS bank. |

|

Intraday calls and Clearing Member pre-funding requests (US PPS) |

16:00 - 21:00 |

As above |

|

Concentration process |

Following every PPS call/prefunding request |

Clearing Members are exposed to PPS banks when funds are on LCH's account at the PPS bank until funds have been transferred to the concentration bank. |

|

Investment activity |

09:00 - 22:00 |

A minimum of 95% of the cash portfolio is invested on a secured basis. |

Looking to reduce your PPS call and pay volumes in respect to segregated client accounts?

Clearing Members at LCH Ltd can now request that individual margin calls for both new and existing client accounts be consolidated into one aggregate margin call by selecting the new PPS Aggregation option within the PPS Preferences form.

Margin calls (and pays) will then be aggregated by PPS account and currency.

Members looking to have any segregated client accounts aggregated together with their regular “C” client OSA account should also request aggregation on the “C” account.

Please see here for more details on PPS Aggregation.

LCH Limited now operates an account with the Monetary Authority of Singapore (“MAS”), on MAS’s RTGS system known as the New MAS Electronic Payment and Book-Entry System (“MEPS+”). Clearing Members may choose to deposit SGD cash directly into this account. If a clearing member wishes to use this service they must opt in by providing LCH with an RTGS mandate. At present, this is the only RTGS arrangement in place.

Please see downloads section below for the RTGS mandate.

Clearing Members at LCH Ltd can inform the clearing house if they wish to meet intra-day margin calls in a preferred currency for a specified mnemonic or sub account.

Click here to provide LCH Ltd with your preferred currency for intra-day margin calls.

LCH invests the cash we receive to cover initial margin and default fund contributions. The key principals backing these investments are capital preservation and liquidity management. Specifically, cash is invested in the following ways:

- Government securities issued by a limited range of high quality liquid issuers

- Secured investment such as reverse repo transactions with high quality credit and financial institutions

- Placement with Central Banks where such facility is available to the CCP

LCH sets cut-off times for both cash collateral deposit and withdrawal from the clearing house as follows:

| Instruction | Deadline (London Time) | Currency |

| Cash Withdrawal | 09:30 | GBP/EUR/USD |

| Cash Withdrawal | 09:00 | SGD |

| Cash Deposit | 14:30 | EUR |

| Cash Deposit | 16:00 | GBP |

| Cash Deposit | 19:00 | USD |

| Cash Deposit | 09:00 | SGD |

| Instruction | Deadline (New York time) | Currency |

| Cash Withdrawal | 09:30 | USD |

| Cash Deposit | 14:00 | USD |

LCH requires a minimum of 2 working days notice for any substitution of collateral in excess of GBP 50mn value. This applies in respect of cash being substituted for non-cash, or vice versa and substituting cash for cash in an alternative currency.

LCH reserves the right to increase the standard notice period and/or exclude specific days by providing advanced notice to Clearing Members via a member circular.