Sponsored Clearing SA

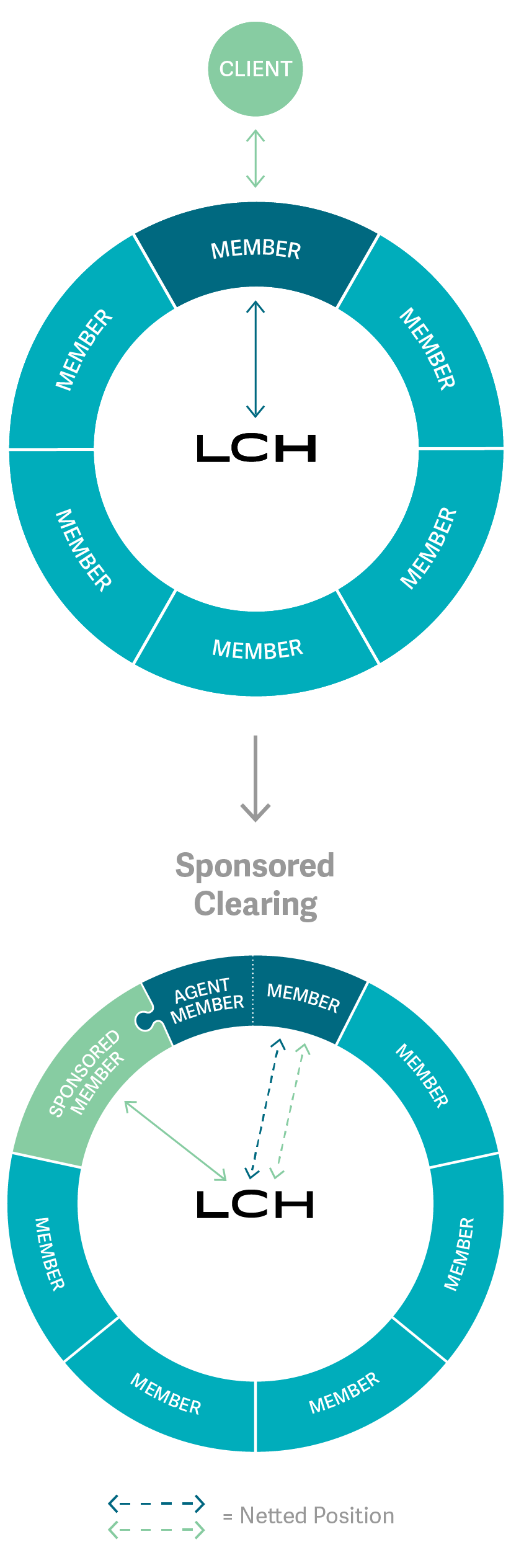

Sponsored Clearing extends the benefits of direct CCP membership to the buy-side community. By inviting member banks to sponsor buy-side direct access to the CCP, LCH provides an innovative way to enhance existing clearing relationships, while generating operational efficiencies for all participants.

Sponsored Clearing seeks to ease the pressure on bank balance sheets by delivering superior capital and margin efficiencies for our membership. This is achieved in part through enhanced netting opportunities across all EUR government markets cleared by RepoClear SA and is available since August 2021.

Sponsored Members join under a new membership category that allows buy-side firms to enjoy the full benefits of clearing through LCH. This creates a direct transactional relationship between LCH and the Sponsored Member, making LCH the counterparty to each cleared trade. Sponsored Members are supported by an Agent Member (sponsoring bank) that facilitates margin payments (as paying agent) and provides default fund contributions for each sponsored transaction.

As LCH expands the breadth of its membership, multilateral netting through RepoClear will increasingly provide superior balance sheet, settlement and risk reductions to our members. By helping manage capital costs and simplifying operational workflows, Sponsored Clearing can free up capital and increase trading capacity.

The Potential Benefits of Sponsored Clearing

For Agent Members (sponsoring banks):

- Increased balance sheet optimization and capital efficiencies

- Opportunities for enhanced customer relationships through the provision of agent services

- Reduced liquidity risks

For Sponsored Members:

- Increased bank capacity for Sponsored Member activity resulting from capital savings

- Reduced bilateral credit risk and default exposures

- Increased operational efficiencies, with settlement netting leading to a reduction in intra-day liquidity requirements

- World-class risk management

Members’ netting opportunities increase as Sponsored Member transactions are cleared, making LCH the counterparty to each trade. The Agent Member role is not restricted to the executing counterparty of the original trade.

The Sponsored Clearing model splits the traditional responsibilities of a clearing member between the Sponsored Member and its sponsoring Agent Member.

Sponsored Member responsibilities

- LCH relationship

Act as the direct counterparty of LCH for each cleared trade

- Trade settlement

Settle directly with LCH, or through their custodian/settlement agent. The Agent Member does not guarantee performance.

- Margin liability

Post margin payments to the CCP, facilitated by their Agent Member

Agent Member responsibilities

- Default fund contributions / waterfall

Provide Default Fund Contributions

- Agent resources

Deliver an additional pre-funded resource to the Sponsored Member’s default waterfall and a buffer for margin cover

- Margin management

Facilitate the payment of the Sponsored Member’s margins in a paying agent capacity via T2 account

Sponsored membership is currently available to pension funds, insurance companies and credit institutions, but with the intention to extend to other regulated funds and selected hedge funds*.

To find out how to become a Sponsored Member, contact us today at repocleargroupsales@lch.com

* Subject to necessary internal governance requirements and regulatory approval